Credit Card Banking Made Easy with Mobile App Development

In this rapidly evolving era, customers demand a quick, secure, and user-friendly banking experience, specifically when they apply for credit cards. To meet these dynamic expectations, Singaporean and Malaysian banks were looking for smart and seamless solutions. They figured out that having reliable mobile app development services can be helpful.

This case study demonstrates how Bloom joined hands with one of the leading financial clients so they could design and deliver a cross-platform mobile application that makes credit card and banking a lot easier for customers in different regions.

About Bloom

Bloom is a globally recognized IT consulting, cloud services, and software development leader. We are known for our unmatched mobile app development services. We assist businesses across various industries in modernizing their operations and enhancing customer experiences while accelerating digital growth.

Accompanied by deep cloud technological knowledge, mobile platforms, and enterprise system understandings, Bloom delivers secure, scalable, and future-ready platforms.

As a renowned mobile application development service provider, we provide customer-centric, agile delivery models, as well as a network of global talent, which led us to become one of the most trusted tech partners for organizations looking for seamless growth and scalability.

About the Client

- The client wanted to develop an app that could work for different banks in Singapore and Malaysia, streamline its processes and hence needed reliable mobile app development services.

- The main aim was to focus on credit card services, such as easily applying for a card as well as figuring out how to use it. This is one of the most sought-after services.

- They needed a centralized application that different banks could use instead of creating different applications from scratch. The idea was to provide ease of usage with centralized control.

- Our team closely worked with their IT team to develop a cross-platform app on Flutter. The aim was to make it iOS and Android-friendly so it could cover a wide range of audiences.

Project Objectives

The company was looking for mobile app development services to create a single and flexible mobile app that multiple banks could easily adapt with minimal customizations. Below are the details of their objectives:

- Centralized App for Multiple Banks: They wanted an app that could work for different banks. We wanted to make sure that this app needed minimum changes for each bank instead of rebranding the whole thing completely for separate clients.

- Easy and Fast Credit Card Apps: We intended for the users to apply for credit cards straight from the app while ensuring that the process is simple, straightforward, and hassle-free.

- Real-time Updates: We wanted our users to view card transactions, payment due dates, and reward points without having to wait for long. So, we positioned our mobile app development services in this direction.

- Follow the rules and Stay Secure: The app had to abide by banking rules applicable in Malaysia and Singapore. Strong security was also essential to guard consumers’ data.

- User Friendly for Everyone: For everyone, young individuals, elderly users, and those not particularly technologically savvy, we wanted the app to be simple.

Key Features We Built

Designed to simplify credit card services, this mobile banking software is also safer and faster. It concentrated on smart assistance, rapid apps, safe login, awards, and easy design. With our mobile app development services, we built the following features.

1. Simple and orderly design

The software featured a clear, understandable design. It was designed for everyone, especially those who find great difficulty using cell phones. The navigation was seamless, and everything was clearly labeled.

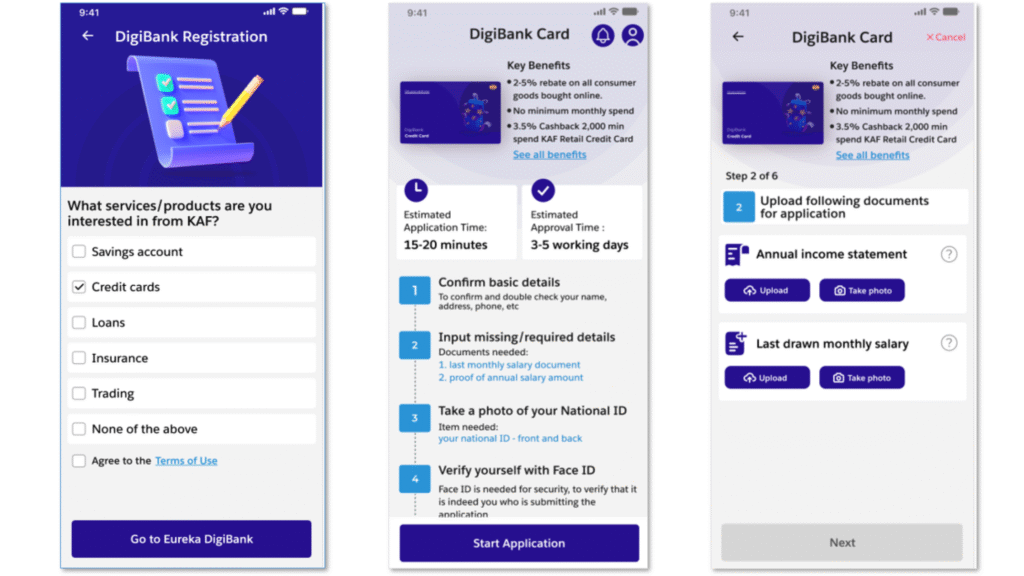

2. Fast Credit Card Application

Applying for a new credit card only requires a few steps for users. Everywhere feasible, the form filled in their details automatically. We also included e-KYC (electronic Know Your Customer), which enables users to use facial detection for online identity verification, eliminating the need to visit a bank.

3. Easy Redemption and Reward Points

Users might log their expenditure-related reward point count. They could also immediately redeem those points straight out of the app without waiting.

4. Safe Biometric Registration

The program lets users log in using Touch ID or Face ID for enhanced security. This made it a safe and quick login.

5. AI Conversational Agent for Assistance

Our mobile app development services delivered a clever chatbot that was on hand around the clock to respond to consumer inquiries on their card, purchases, or features.

6. Traveler Currency Conversion

Real-time conversion of currencies via the app will enable consumers to view expenditures on travel abroad.

Difficulties We Encountered (and Resolved)

- Different National Policies : Banking rules varied among nations. We addressed the issue by developing modular code, therefore enabling simple rule modification for every area.

- e-KYC with Face Detection : Our mobile app development services included face scanning so consumers may confirm their identity without physically visiting the bank.

- Like on iOS and Android : We made sure the app appeared and operated on both platforms exactly.

- Interacting with Several Bank Systems : While some banks adopted modern systems, others still employed antiquated ones. We developed adaptable APIs to interface both kinds easily.

- Adhering to All Policies : Working together with the legal teams, we made sure the app satisfied the banking criteria for Malaysia (BNM) and Singapore (MAS).

How We Collaborated

1. Using an Agile hybrid approach

- This means that rather than developing everything at once, with our mobile app development services, we worked in small portions methodically.

- We received new assignments every two weeks that kept us on target and enabled rapid development.

2. Consistent client meetings

- We had close contact with the teams of the client covering legal, compliance, and banking activities.

- These groups made sure that the app operated as banks expected and complied with all guidelines.

- We routinely made updates, got comments, and spoke about developments.

- We completed three distinct phases.

3. PoC: Proof of Concept

- The first edition of the app was a PoC.

- In our mobile app development solution, we developed the primary credit card features, such as applying for a card and e-KYC identity verification.

- This period lasted three months.

- It lets the client test and grasp how the program would function.

4. MVP: Minimum Viable Product

- We introduced more valuable tools, including incentive monitoring analytics and spending insights, in the next two months.

- These tools motivated users daily to utilize the app.

5. The Complete Launch

- We intended to release the software over several areas once everything was developed and tested.

- This phase lasted only one more month and moved quickly.

- The software was ready for actual users from many banks in Singapore and Malaysia.

Delivery Timeline

| Phase | Duration | Key Deliverables |

| Discovery | 4 Weeks | Gathered requirements, finalized features |

| PoC | 12 Weeks | Built credit card application and eKYC |

| MVP | 8 Weeks | Added analytics, rewards, chatbot |

| Full Launch | 4 Weeks | Released app for multiple banks |

Technology We Used

We created quick, safe, and easily navigable software using contemporary, dependable technologies. Every tool was crucial in our mobile app development services to ensure that performance monitoring, upgrades, and development went seamlessly and quickly. Here is a list of technologies we used:

- Flutter: The front end of the app that users view and use was created with Flutter. It lets us design one app that runs flawlessly on iOS and Android devices.

- Network.NET: .NET was used to build the backend in our mobile app development services, which is server-side. This addressed the main logic, including securely storing data and handling application processing.

- Azure Database: Our app’s database was Azure SQL. Including user information, transaction records, and reward points, it securely kept all the key data.

- Azure DevOps & GitHub Actions: These instruments enabled us to release the latest app versions automatically, therefore saving time. This enables safer and faster modifications.

- FireBase: User usage of the app was tracked using Firebase. It enabled quick fixes for any problems and performance monitoring.

Results for the Customer

The client benefited a lot from our mobile app development services:

- 30% Faster Onboarding: Smart forms and online ID checks let users obtain a new credit card faster.

- 20% more card applications: The straightforward layout urged more people to apply for cards.

- 15% more user engagement: Thanks to useful alerts and reward monitoring, users engaged more with the app.

- Reduced Operational Costs: By cutting hand labor, automated features like eKYC and chat support helped save money.

- improved UI/UX design: Working with the client, we ensured the design was simple to use and fit their vision.

- API Testing Support: We tested the bank’s APIs to ensure they operated as expected in the app prior to including certain capabilities.

Market Influence

Plans for Future

We have interesting ideas for future iterations of the app to make it even more outstanding with our mobile app development services:

1. E-Wallet Integration

We will also incorporate well-known digital wallets such as PayNow and GrabPay. For consumers, this will accelerate and simplify bill payments and money transfers.

2. Thoughts on Credit Score

Users will be able to view their credit score, grasp how it’s computed, and obtain advice on how to raise it.

3. Payments Powered by Voice Activation

In our mobile application development services, we ensured AI will enable consumers to pay just by speaking in the near future. It will make paying the bills considerably handier.

4. Support of Many Languages

Future support of more languages by the software will enable everyone to utilize it in their favorite language, therefore promoting inclusiveness and usability.

Conclusion

With this project, the customer advanced significantly into digital banking with the help of our mobile app development services.

Users in Singapore and Malaysia may now quickly apply for credit cards, track their expenditures, and benefit from one basic, safe, and strong software.

Using Flutter, contemporary cloud tools, and great teamwork helped us to deliver the project on time, on budget, and with actual commercial value.

If you are looking for mobile app development services, you can visit us here.

Frequently Asked Questions

Q1. How much does it cost to develop a mobile app?

The average cost of building a basic app may range from $5,000-$50,000. However, the overall cost may depend upon the mobile app development company, the developer’s experience, the location in which an app is being developed, and so on.

Q2. What technologies are best for building a secure credit card mobile app?

The best technologies for credit card banking apps include Flutter for cross-platform development, .NET for backend logic, Azure SQL for secure data storage, and Firebase for performance monitoring. These ensure scalability, security, and smooth performance across both iOS and Android.

Q3. What are the key features customers expect in a credit card mobile app?

Users expect features like fast credit card application with e-KYC, biometric login, real-time rewards tracking, AI-powered chat support, secure transactions, and multi-currency conversion. These features make digital banking simpler, faster, and more secure for users.

Q4. How did Bloom ensure compliance with banking regulations in Singapore and Malaysia?

Bloom collaborated closely with client compliance and legal teams to align the app with Monetary Authority of Singapore (MAS) and Bank Negara Malaysia (BNM) guidelines. By using modular code and secure APIs, the app was built to adapt to regulatory requirements in both regions.