Modernizing Finance Apps with Web App Development

In this dynamically evolving digital era, traditional institutions are under immense pressure to adopt digital-first strategies and modernize their legacy systems. They also have to make sure that their reliability, compliance, and precision are not compromised. The easiest way to stay relevant in the market is to embrace web app development services.

This case study demonstrates how Bloom partnered with one of the leading US-based financial service firms and revolutionized their 20-year-old Windows-based loan processing system.

They aimed to retain the robustness of the backend calculations while making the user experience smooth.

About Bloom Consulting Services

Bloom is a globally recognized tech company that assists businesses in moving to the cloud, updating old systems, and creating modern digital solutions. Web application development is one of the services.

We work with various industries, such as finance, healthcare, F&B, etc., and make sure their technology works faster and smarter while providing more output than expected.

Our core strength lies in upgrading old software, building Azure cloud systems, designing and developing easy-to-use applications, and optimizing flexible working methods such as Agile. We further ensure that everything is safe and abides by the legalities.

We strive to help companies grow, operate more smoothly, and stay ahead in this competitive market.

About the client

- The client is one of the primary financial service providers based in the US.

- Since they offer complex loan services as well as lending products, their client base typically consists of institutional and large commercial borrowers.

- The firm relied on a 20-year-old Windows desktop application that helped them precisely model finances, analyze risks, and calculate amortization.

- Despite being functionally robust, the system has become obsolete in terms of the user interface, maintainability, and accessibility.

- The client came to us with a vision of altering the UI/UX part without changing the backend logic, which ensured computational precision and regulatory compliance. Our web app development services ensure that they get what they were looking for.

Product Objective

The primary objective of this web app development project was to build a user-friendly web app that matched the capabilities of their desktop apps. The project aimed at resolving the key challenges arising, such as:

- Outdated User Experience: The legacy systems had a very poor user interface, which was hard to adapt and lacked responsiveness to modern devices.

- Limited Accessibility: Since it was a desktop-only app, it didn’t support scalability and remote access, hindering modern work flexibility.

- High Maintenance Costs: The system was expensive and difficult to maintain as it was built on C++ and older frameworks. However, our web app development strategy tackled it effectively.

- Competitive Disadvantage: New-age fintech firms offer more intuitive apps. Therefore, putting more pressure on the client to evolve as per the market demands.

Technology Challenges and Solutions

There were various technical challenges that emerged during the engagement. Especially when it came to integrating the modern front-end with a legacy backend:

| Category | Problem | Solution |

| Adapter Layer of API Normalization | Their legacy backend APIs were not consistent in response formats and data structures. | To address this, we developed an adapter layer to normalize responses and handle discrepancies. This ensures smooth communication between the front-end and back-end. |

| WebSocket Integration for Real-Time Updates | Real-time updates played a critical role in displaying changing loan matrices as well as risk factors. It needed careful coordination and extensive testing. However, our web app development experts were there for the rescue. | We added a middle layer that optimized WebSockets to send real-time updates to the web application. Since the previous system couldn’t send updates straight, this layer ensured that the gap was filled. |

| Complex UI Management | The UI had to fit a lot of risk scenarios, loan types, and user roles based on the inputs and outputs. | We applied modular design principles and responsive layouts to streamline complexities and ensure scalability. |

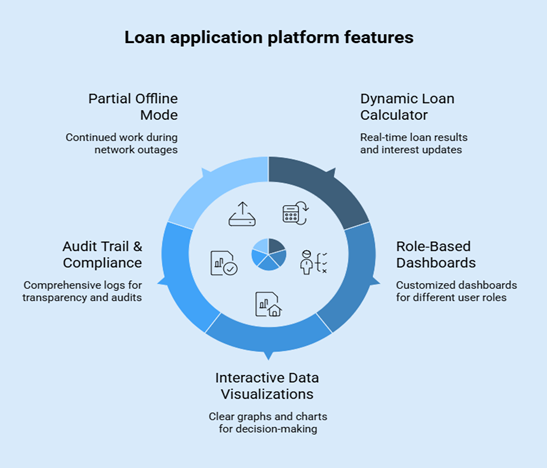

Key Features Delivered

We identified and implemented the given high-impact features as a part of our web app development service:

- Dynamic Loan Calculator: The new web app allows users to see real-time results for loan calculations, risk checks, and interest rate changes. It can put data from the API and give fast feedback. It focuses on saving a lot of waiting time, unlike their legacy system.

- Role-Based Dashboards: We developed different dashboards catering to different sectors of users, such as loan officers, auditors, underwriters, and so on. Every one of them individually sees the information and tools they need, which makes the process a lot faster and easier.

- Interactive Data Visualizations: Users can easily make quick decisions by looking at the visuals we provide. We used Highcharts to build easy-to-read graphs and charts demonstrating loans, trends, comparisons, and performance.

- Audit Trail and Compliance Logging: To meet legal requirements, the application stores detailed records of every user’s actions. These logs make checking activities easier during internal audits and official reviews.

- Partial Offline Mode: To support users with limited access to the internet, we introduced a feature that stores data locally as a part of our web app development. This allows users to work continuously even when there is no network.

Our Engagement Approach

In order to manage risks and ensure flexibility, we adopted a hybrid agile delivery model. The engagement was structured into 4 phases:

Discovery Phase (4 Weeks)

- Our web app development experts conducted a detailed API analysis to understand their legacy backend structure.

- Our team then created interactive UX prototypes to validate the new workflows with the client’s key stakeholders.

- Then, we identified the core use case so we could focus on development in high-impact areas.

Development Phase (12 Weeks)

- We followed an iterative development approach with bi-weekly sprints.

- Then, we rolled out features based on the feedback we received.

- Finally, using a custom-built adapter layer, we developed an Angular frontend and integrated it with the APIs.

Testing Phase (6 Weeks)

- We kept their legacy features as a benchmark and then conducted User Acceptance Testing.

- To ensure its stability, we performed extensive regression testing.

- We further ensured security, performance, and cross-browser compatibility.

Deployment Phase (2 Weeks)

- In this phase, we managed a phased rollout so we could reduce risk and allow gradual adoption.

- We provided documentation and training so we could facilitate onboarding.

- We then made sure there was zero downtime during migration to reduce operational disruptions.

The Technology Stack We Used

This solution was built on modern technology stacks customized to the client’s compliance needs and preferences.

- Frontend: This was selected by the client for in-house maintainability.

- UI Framework: Angular Material was used for accessible and consistent UI components. And thus, providing intuitive UI/UX design and development.

- Data Visualization: Highcharts were preferred for rendering interactive financial charts.

- API Integration: REST APIs and WebSockets were used for real-time data flow.

- Security: For security, we utilized OAuth 2.0 and JWT for secure authentication and authorization.

- Testing Framework: Cypress was used for end-to-end testing and quality assurance.

Team Composition and Timeline

To deliver this ambitious transformation, our web app development professionals assembled a cross-functional team comprising:

- 1 Project Manager/ Business Analyst

- 4 Angular Developers

- 1 UX/UI Designer

- 2 QA Engineers

The timeline was divided as follows:

- Discovery and prototyping: 3 weeks

- Core Development: 8 Weeks

- UAT and Compliance Checks: 4 Weeks

Though the project had complex technical demands, it was completed within the scheduled time and aligned with all the key milestones.

Business Impact

The new web application delivered unmatched benefits. Some of them are as follows:

- Enhanced Accessibility: Thanks to browser-based access, the employees could work remotely and securely, which significantly enhanced their operational flexibility.

- Faster Loan Processes: With real-time updates and simplified workflows, manual input errors were reduced, which caused a 40% improvement in processing times.

- Boosted User Productivity: The intuitive UI led to a 30% increase in productivity for the end users, especially underwriters and analysts.

- Reduced Training Costs: Easy-to-use navigation and onboarding tools reduced the learning curve, which ultimately reduced training time and expenses by 50%

- Smooth Transition: During the switch, there was zero downtime and higher user satisfaction during the phased migration approach.

- Future Readiness and Scalability: This app is now ready to update and scale as per requirements due to its modular architecture. It can easily update to new features and meet compliance requirements.

Market Positioning Benefits

Apart from internal benefits, with our web app development, they could improve their overall market image and open new avenues of opportunities:

- Modern Lender Perception: Among the emerging fintech competitors, our client successfully positioned itself as a modern financial service provider that optimizes a cutting-edge platform.

- Borrower Satisfaction: With a state-of-the-art product, our client could streamline application processing faster, which would eventually improve satisfaction levels among institutional clients.

- SMB Market Expansion: It is easier for the client to expand their services to small and medium businesses with a cloud-first design. They could now easily lend space, which was previously a segment left untouched due to the platform’s limitations.

Results and Outcomes

With the help of our web application development company, the client was able to yield several tangible results:

- User Adoption: More than 90% of the users transitioned to the new platform within the first three months after its launch.

- Regulatory Approval: The app successfully passed audits by the SEC and other financial authorities without facing any compliance issues.

- Positive Stakeholder Feedback: Internal stakeholders across IT, legal, and finance teams claimed higher satisfaction and ease of use.

Conclusion

The IDS IACloud project shows how modernizing legacy financial systems can be done without disturbing fundamental business logic or regulatory compliance. Our customer future-proofed their operations, enhanced user experience, got the best user interface design, and acquired a competitive edge in an ever-changing financial environment by developing a strong, responsive, and safe web-based application.

This involvement emphasizes the need for strategic modernization as a vital business enabler in the digital age, not only as a technological improvement.

If you are looking for the best web app development company, you can visit us here.

Frequently Asked Questions

Q1. What is Web App Development?

Web application development is the process of developing software apps that can be accessed via web browsers and run on web servers.

Q2. What are web app development services?

These services can be referred to as creating custom web apps. A custom web app is extremely important for a business as it can help strengthen your relationship with your customers.

Q3. How much does web app development cost?

It can range anywhere between Rs. 70,000 – Rs. 1,20,000 in India. However, the exact cost may depend upon various factors, such as the band that is building an app for you, the expertise of their developers, the country in which the app is being developed, the complexity of the app, and so on.

Q4. What are UI/UX development services?

UI/UX services focus on developing user-friendly and visually appealing products. These services contain both User Experience (UX) as well as User Interface (UI).

Q5. How can web app development help in upgrading old finance software?

Web app development transforms outdated desktop-based systems into flexible, browser-accessible platforms. It improves accessibility, reduces maintenance costs, and enhances user experience without altering critical backend logic. For finance firms, this means faster loan processing, better compliance, and real-time data access across teams.

Q6. What challenges are common when modernizing legacy applications in finance?

Common challenges include integrating modern front-ends with legacy backends, ensuring data consistency, maintaining compliance, and achieving real-time updates. Our case study shows how Bloom solved these issues using an adapter API layer, WebSocket integration, and modular design principles for smooth modernization.

Q7. What technologies are best suited for modern web app development in the financial sector?

Technologies like Angular (for UI), .NET (for backend), Highcharts (for data visualization), OAuth 2.0 and JWT (for security), and Cypress (for testing) are ideal. They offer security, scalability, and high performance, making them perfect for finance web applications requiring real-time data and regulatory compliance.