Modernizing Lending Policy and Process Through Web App Development for a Leading FinTech

In this ever-evolving world, financial technology plays a crucial role in enabling businesses to receive financial assistance. However, even the best companies can face challenges when working on outdated and difficult systems. In this case, they seek web app development services.

This case study demonstrates how we assisted one of the leading Fintech brands in India with improving their lending processes and policies. We built a user-friendly application named Policy UI and moved them from a slow, manual, legacy system to an automated one.

About Bloom

Bloom is a globally trusted solution partner that assists businesses in solving complicated issues using simple and modern technology. We closely work with clients to build solutions and understand their needs that are easy to use and bring value as well.

Bloom’s web application development services emphasize developing tools to enhance business processes, boost productivity, and support growth. We optimize proven methods and the latest technologies, as well as a strong team of experts who deliver high-quality results in a timely manner.

About Client

- With headquarters in Mumbai, the client is among the leading FinTech companies in India. Their area of expertise is offering digital lending options.

- Small and medium-sized businesses (SMEs), who frequently find it difficult to get loans through conventional banks, are their key consumers. Faster, easier lending options are the client’s means of bridging this divide.

- They run entirely online, enabling companies to apply for and handle loans via a digital portal. Long paperwork and in-person visits are eliminated as a result.

- The company’s goal is to eliminate the hassle associated with borrowing by providing quick access, flexible structure, and enough loans with the help of suitable web app development services.

- Their long-term objective is to make financial access as easy as a button click. They see technology as enabling quick, clear, hassle-free lending.

Problems With Their Old Process

The client was handling their lending process manually and using an antiquated system prior to when we started the project. For their team, this brought them several difficulties.

| Problem Area | Description |

| Hard to Work Together | Working together using outdated techniques became challenging for team members. People sometimes worked on several versions of the same documents since there was no appropriate method to record changes. |

| Errors and Conflicts | Since everything was done by hand, small mistakes sometimes caused major issues. Identifying the loan policy version became very difficult. This made it crucial for them to get web app development services. |

| Dependency on Excel | The group tracked policy updates and loans using Excel files. These documents were difficult to handle, leading to confusion. |

| Too Many Emails | Important updates arrived by email, leading to missed messages and delays. Nobody could clearly observe what was happening from one single location. |

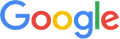

What did the Client Need?

The client wanted to create something straightforward, modern, and smooth to replace their system. For the new application, they clearly thought of specific objectives.

A Clean and Simple Interface

They wanted the application to appear simple, modern, and neat. One should be able to use it without difficulties even if one is not tech-savvy.

Easy to Use and Understand

The customer insisted on a fast-learning method for its users. It should not call for sophisticated user guides or hours of instruction.

Auto Reject Based on Rules

If a customer’s loan application falls short of specific guidelines, the system must instantly reject it. This would save time and reduce the need to review every single instance personally. This is where our web app development services played a major role.

High Security

The client works with private financial data; hence, the system has to be quite safe. Data should only be viewable or editable by the authorized persons.

Automation

They sought less manual work. The system should run without continual attention, track changes, and manage alerts.

Rule-based Workflow

The client wished to establish and change system rules. These guidelines would help control loan approvals or rejections.

Our Solution

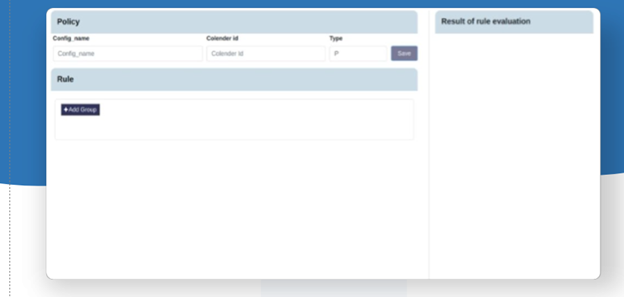

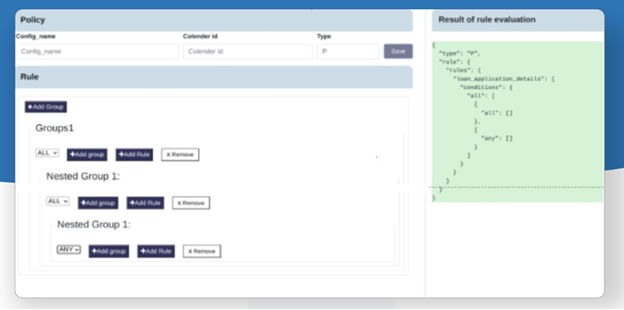

To address all these issues and satisfy client expectations, we created a web application called PolicyUI. The new system made their jobs far simpler and more effective. Our web app development services provided them with tangible results. Some of them are as followed:

- Smart Auto-Rejection Rules: We included a rule engine built from JSON that automatically reviews every loan application. Should it fall short of the required income or credit score, the algorithm immediately rejects it, therefore saving time and effort. We served it as a part of our business automation services.

- Modern and Simple User Interface: Designed to steer people step-by-step, the new UI is neat and simple to use. This clarifies things and speeds up task completion free from error.

- Smooth Transition from Manual Work: Since the customer had never used any program previously, with our web app development services, we made sure PolicyUI was understandable. With little instruction, team members soon adjusted to it.

- Strong Security Measures: To protect private information, we developed robust access restrictions. Loan-related information is viewable, updateable, or approved only by authorized users.

- Automated Tracking and Alerts: Nowadays, the system keeps track of every action and delivers automatic alerts. It also preserves a complete audit trail, therefore enabling the team to keep orderly and avoid manual labor.

Technology Used

With our web app development services, we developed the PolicyUI application by combining dependable, scalable, and low-maintenance front-end and back-end technologies.

| Technology/ Methodology | Usage |

| Angular JS | A dynamic and responsive user interface was developed using AngularJS. It lets us make the application interactive so users can complete tasks in real-time without refreshing the page. |

| JavaScript | The fundamental programming language used in our web app development services was JavaScript. It drove all the significant system operations, including back-end communication, rule processing, and user input validation. |

| HTML & CSS | Our custom web application development services ensured that the program was easily navigable, looked clean on many devices, and operated well on others as we designed and styled the application using HTML for content organization and CSS. |

| JSON (JavaScript Object Notation) | Rules that were set for auto-rejection of loan applications, were stored and controlled using JSON. Without intricate coding, this human-readable style made defining, updating, and processing rules simple. As one of the top app development companies, we ensure that this criterion is met. |

| SCRUM Methodologies | To run the project, we applied the SCRUM method in web app development services. We thus constantly discussed comments with the client, provided working software in phases, and worked in short development cycles, often known as sprints. This kept us on target and enabled quick adaptation to any modification in criteria. |

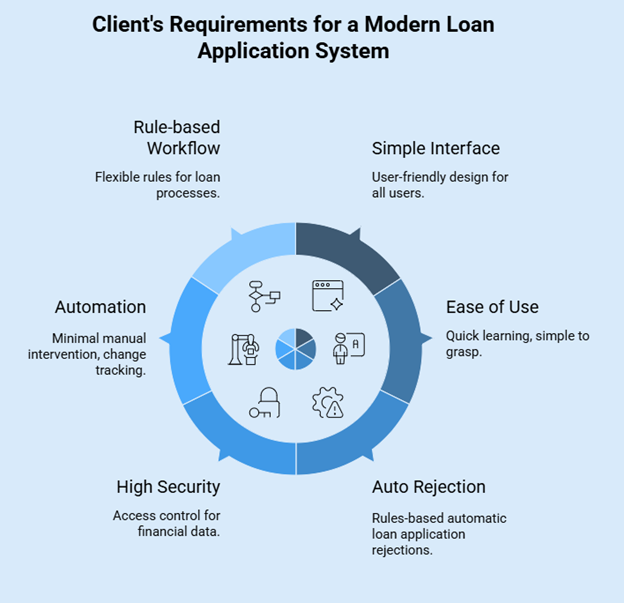

Project Team

To properly implement the PolicyUI application, we put together a talented, diverse project team via our web app development services. Each individual brought special skills and expertise to the table.

- Product Owner: Between the client and the development employees, the product owner served as a link. He made sure we precisely grasped the client’s vision, goals, and commercial needs.

- Scrum Master: The Scrum Master was responsible for guiding the team through the SCRUM procedure. They guaranteed flawless communication, cleared obstacles, and kept the team concentrated on producing results.

- SharePoint Architect: As one of the best app development companies, we provided a SharePoint Architect who had expertise in data structure and integration. They assisted in designing components of the system, including data flow inside safe environments and document handling.

- Lead SharePoint Developer: This person greatly aided in developing basic back-end logic and tools. He enabled data management, user access, and safe policy handling, among other things.

- Web Developer: In our web app development services, the application’s design and feel dominated the web developer’s attention. They ensured the user interface matched current design standards, was appealing, and clear-cut.

- Business Analyst: The business analyst helped the customer compile comprehensive needs. They turned these into well-defined development projects and ensured that the features we created met actual demands.

- Quality Assurance (QA) Engineer: The QA engineer thoroughly tested the system. He discovered and fixed errors before they were published, therefore guaranteeing the stability, dependability, and error-free final product.

Impact on the Business

The launch of PolicyUI clearly and favorably changed the client’s loan operations management. Our web app development services turned their laborious, manually operated processes into a simplified, automated system.

- Clear View of Loan Applications: The team used email threads and scattered Excel spreadsheets to monitor loan progress prior. Everything is now available on one dashboard – loan applications, statuses, timeframes, and decisions all in a single location. This enables the team to act faster and improves their control over operations.

- Easy Access to Updated Lending Policies: Lending policies might vary depending on internal reviews, risk policies, or state of the market. Maintaining everyone on the same page under the old method proved challenging. All users are always working with the most recent version as PolicyUI stores the newest policies centrally and updates them in real-time.

- Complete Record of All User Actions: Every action a user takes, be it altering a policy, updating a loan record, or turning down an application, can now be automatically noted. Especially in internal reviews or external audits, this audit trail supports responsibility and openness. It also facilitates speedy problem-solving as needed.

Conclusion

This project aimed to transform the client’s working process rather than only provide a fresh tool. They evolved from a disorganized, manual procedure to a clever, computerized system enabling faster and more accurate customer service.

PolicyUI lets them handle the lending rules without depending on Excel or email. These days, the system handles application tracking, application rule application, loan rejection of unfit candidates, and security maintenance overall.

Basically, this solution enabled the client to advance significantly on their digital path. With a solid infrastructure to help them, they are now much closer to their objective of “Financial Access at a Click.”

If you are looking for web app development services, you can visit us here anytime and one of our agents will get back to you as soon as possible.

Frequently Asked Questions

Q1: What are web app development services?

These services can be defined as the process of developing customized apps. Such apps have become an important aspect among businesses to reinforce their relationship with their customers.

Q2: What are business automation services?

They can be defined as the services that optimize technology to automate and streamline repetitive tasks as well as workflows. Therefore, enhancing accuracy, efficiency, as well as productivity in an organization.

Q3: What does a web application developer do?

A web app developer focuses on designing, testing, coding, as well as maintaining apps. They typically create (UI) using HTML, Javascript, and CSS.